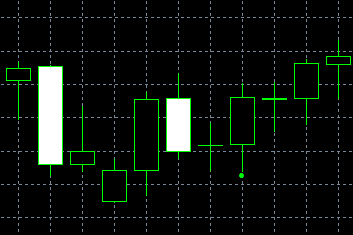

The Three Inside Up and the Three Inside Down confirm the Harami model as the first two days of these two patterns are the Harami itself. The third day of the pattern confirms the closing price in any trend, bullish or bearish.

The Harami in the bullish market is followed by a higher close of the third day and indicates the Three Inside Up formation. The bearish Harami with a lower closing price turns into the Three Inside Down pattern.

How to determine Three Inside Up and Three Inside Down

1. First, the Harami pattern should be recognized on the chart.

2. If the third day closes higher, the Three Inside Up pattern forms; and in case of a lower close, the Three Inside Down appears.

Scenario and psychology

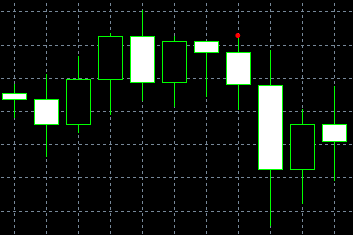

Being the confirmation of the Harami pattern, the models point to the successful Harami formation only if the price moves in the expected direction.

Flexibility

The patterns are as flexible as the Harami. The size and intensity of the second candle can make the models weaker or stronger.

Development

The bullish Three Inside Up can develop into the Hammer pattern; while the bearish Three Inside Down can become the bearish Shooting Star. In both cases, developments support the pattern’s character.