Analysis of Trades and Trading Recommendations for the Euro

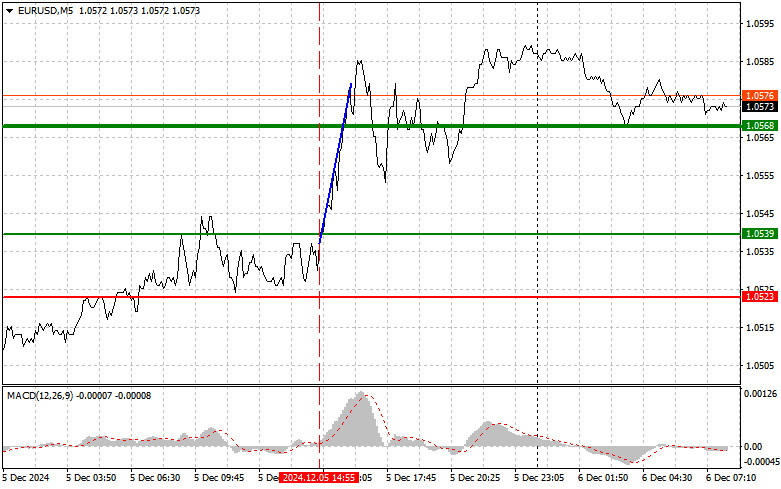

The test of the 1.0539 price level occurred when the MACD indicator had just begun to move upward from the zero mark, confirming the correct entry point for buying the euro. As a result, the pair rose by more than 30 pips, reaching the target level of 1.0568. However, selling from that level on a rebound did not yield the expected profit.

In the first half of today, the euro may continue to strengthen against the dollar, but this will require positive data from the Eurozone.

The release of data on Germany's industrial production could significantly impact the pair, particularly since Germany's economy is one of the key drivers in the Eurozone. Supply chain disruptions and declining orders are expected to place significant pressure on overall industrial output. Traders will closely monitor these figures to gauge the overall condition of the manufacturing sector, which has been facing considerable challenges recently.

The trade balance data will also be a critical indicator for assessing Germany's foreign economic activity. An increase in export volumes could signal a recovery in demand for German goods, positively impacting gross domestic product. Analyzing this data will provide insight into how Germany's trading partners react to global economic changes and shifts in consumer habits.

The most important event remains the release of Eurozone GDP data for the third quarter. Projections indicate no changes, with growth expected to stay at 0.4%. Only in the case of a significant downward revision would the euro respond with a substantial decline. I will primarily rely on implementing Scenarios 1 and 2 for today's strategy.

Buy Signal

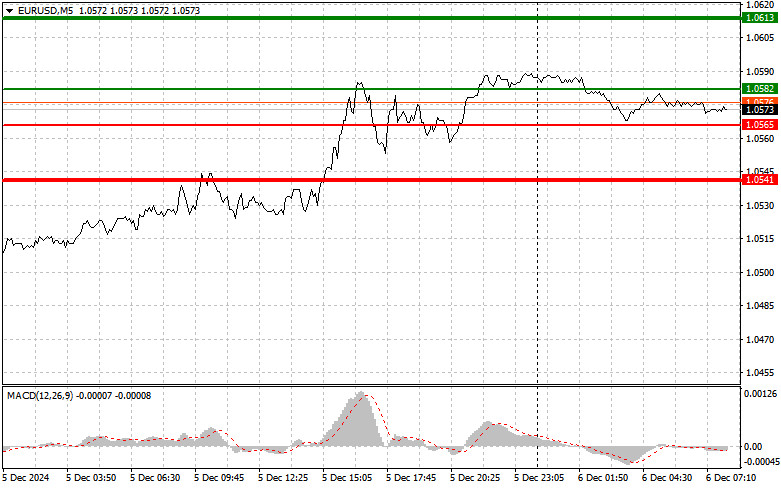

Scenario 1:

Today, consider buying the euro at the price level of 1.0582 (green line on the chart) with a target of 1.0613. At 1.0613, I plan to exit the market and sell the euro in the opposite direction, aiming for a movement of 30–35 pips from the entry point. Growth in the euro is likely in the first half of the day, but only if positive data is released.

Important: Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario 2:

I also plan to buy the euro today if the price tests the 1.0565 level twice while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth to the opposite levels of 1.0582 and 1.0613 can be expected.

Sell Signal

Scenario 1:

I plan to sell the euro after reaching the 1.0565 level (red line on the chart). The target will be 1.0541, where I intend to exit the market and immediately buy in the opposite direction, aiming for a 20–25 pips movement in the opposite direction from the level. Pressure on the pair may return anytime, but selling from higher levels is better.

Important: Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario 2:

I also plan to sell the euro today if the price tests the 1.0582 level twice while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.0565 and 1.0541 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.