Análisis de las operaciones y consejos para operar con el euro

La prueba del nivel de precio 1.0317 durante la segunda mitad del día coincidió con un momento en que el indicador MACD ya se encontraba muy por encima de la marca cero, lo que limitaba el potencial alcista del par. Por esta razón, no compré el euro. No se presentaron otros puntos de entrada al mercado.

Las declaraciones de los representantes de la Reserva Federal de ayer mantuvieron la demanda del dólar estadounidense. Michelle Bowman afirmó que la inflación sigue siendo alta y que ve riesgos de que su crecimiento se reanude. Según su opinión, la reducción de tasas en diciembre debería ser la última hasta que la situación con el aumento de precios se estabilice. Patrick Harker también señaló que se necesitará más tiempo del esperado para reducir la inflación al 2%, y que la Fed debería tomar una pequeña pausa ante las condiciones de incertidumbre.

Hoy, en la primera mitad del día, no hay estadísticas importantes para la eurozona, pero no se deben ignorar las cifras sobre el cambio en el volumen de los gastos de consumo de Francia y el cambio en el volumen de producción industrial, así como los datos sobre el cambio en el volumen de ventas minoristas de Italia. Solo datos muy débiles llevarán a una venta del euro antes de la publicación de los informes relacionados con el mercado laboral estadounidense.

En cuanto a la estrategia intradía, me centraré más en la implementación de los escenarios nº 1 y nº 2.

Escenarios para la compra

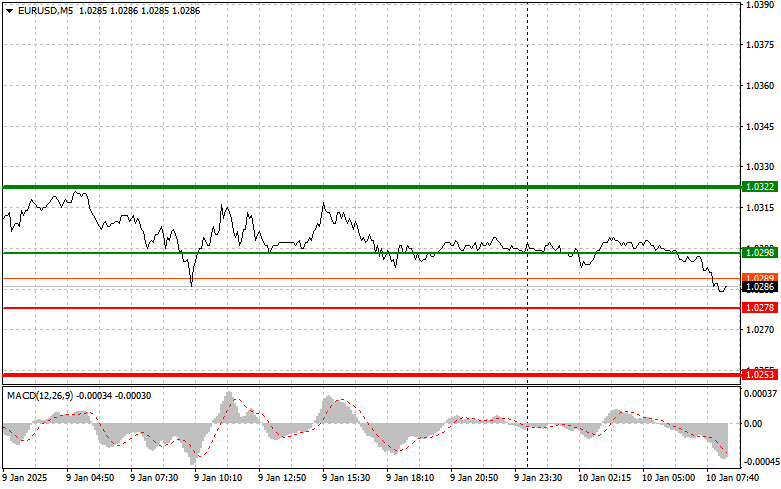

Escenario nº 1: hoy se puede comprar el euro al alcanzar el precio en la zona de 1.0298 (línea verde en el gráfico) con el objetivo de una subida hacia el nivel de 1.0322. En el nivel 1.0322, planeo salir del mercado y vender el euro en la dirección opuesta, esperando un movimiento de 30-35 puntos desde el punto de entrada. Solo se puede considerar una subida del euro en la primera mitad del día tras la publicación de buenas estadísticas. ¡Importante! Antes de comprar, asegúrese de que el indicador MACD esté por encima de la marca cero y solo comenzando a subir desde ella.

Escenario nº 2: también planeo comprar el euro hoy en caso de dos pruebas consecutivas del precio de 1.0278, cuando el indicador MACD esté en la zona de sobreventa. Esto limitará el potencial bajista del par y provocará un cambio de tendencia al alza. Se puede esperar una subida hacia los niveles opuestos de 1.0298 y 1.0322.

Escenarios para la venta

Escenario nº 1: planeo vender el euro tras alcanzar el nivel de 1.0278 (línea roja en el gráfico). El objetivo será el nivel de 1.0253, donde planeo salir del mercado y comprar inmediatamente en la dirección opuesta (esperando un movimiento de 20-25 puntos en dirección contraria desde el nivel). La presión sobre el par puede regresar en cualquier momento. ¡Importante! Antes de vender, asegúrese de que el indicador MACD esté por debajo de la marca cero y solo comenzando a bajar desde ella.

Escenario nº 2: también planeo vender el euro hoy en caso de dos pruebas consecutivas del precio de 1.0298, cuando el indicador MACD esté en la zona de sobrecompra. Esto limitará el potencial alcista del par y provocará un cambio de tendencia a la baja. Se puede esperar una caída hacia los niveles opuestos de 1.0278 y 1.0253.

Qué tenemos en el gráfico:

La línea verde fina es el precio de entrada al que se puede comprar el instrumento de negociación.

La línea verde gruesa es un presunto precio, en el que puede colocar Take profit o fijar las ganancias por su cuenta, ya que es improbable un mayor crecimiento por encima de este nivel.

La línea roja fina es el precio de entrada al que puede vender el instrumento de negociación.

La línea roja gruesa es un precio presunto en el que puede colocar Take profit o fijar las ganancias por su cuenta, ya que por debajo de este nivel es poco probable una mayor caída.

El indicador MACD. Al entrar en el mercado es importante guiarse por las zonas de sobrecompra y sobreventa.

Importante. Los operadores principiantes en el mercado Forex deben tener mucho cuidado al tomar decisiones sobre la entrada en el mercado. Antes de la publicación de informes fundamentales importantes, lo mejor es mantenerse fuera del mercado para evitar verse atrapado en fluctuaciones bruscas de las cotizaciones. Si decide operar durante la publicación de noticias, coloque siempre órdenes Stop para minimizar las pérdidas. Si no coloca órdenes Stop, puede perder todo su depósito muy rápidamente, sobre todo si no utiliza la gestión de Capital y opera con grandes volúmenes.

Y recuerde que para operar con éxito es necesario tener un plan de trading claro, como el que he presentado anteriormente. Las decisiones de trading espontáneas basadas en la situación actual del mercado son una estrategia intrínsecamente perdedora para un trader intradía.